Legal Entities in Vietnam: Which One to Choose?

The foundations you lay for your business namely, the type of legal entity you choose for entering the market will determine the success of your future business. In this guide, we will give you a thorough overview of legal entities in Vietnam, and help you decide whether you should set up a company for doing business in Vietnam or would it be more cost-effective to bypass the process and concentrate on a faster market entry via outsourcing.

Why set up a legal entity in Vietnam?

Investors set up legal entities in Vietnam for the same reason as anywhere else in the world:Â legal entities provide a barrier between personal wealth and business assets.

For example, in case you find your business in financial troubles, or any other problem occurs, having a legal entity will protect your personal assets and property from creditors.

Types of legal entities in Vietnam available to foreign investors

1.Limited liability company (LLC)

In Vietnam, a limited liability company does not have shares or shareholders, and company owners are not shareholders but members. Ownership depends on the capital contributed, or as agreed between members.

In most cases, the founder will determine how many members to include in the incorporation process. The upper limit is 50 members. The minimum can be one person, for a one-person company. Note that joint-ventures in Vietnam require a minimum of two members.

As the name implies, member liability is limited. If a member as contribution, for example, is USD 10,000 and they have made it in full, they have legally fulfilled their duty. Should the company get into financial difficulties, the memberâs other assets and funds will remain safe.

Minimum capital requirement in Vietnam

Although there is nominimum capital requirement in Vietnam, the capital you contribute must reflect your planned expenses.

From our experience, the most common minimum capital amount for setting up an LLC in Vietnam is US$ 10,000, and you can register a service sector company with even as little capital as US$ 3,000.

Therefore, if youâre planning to establish a small or a medium-sized enterprise (SME) in Vietnam, the most suitable option would be to set it up as an LLC.

To learn more about the requirements and the exact process of setting up a limited liability company, read our guide to company registration in Vietnam or get started with yourcompany registration in Vietnam here.

2.Joint-stock company (JSC), also known as a shareholding company

A joint-stock company in Vietnam is similar to an LLC, but for larger businesses. The minimum number of shareholders increases to 3 for JSCs, and the corporate structure is slightly more complicated.

A JSC also needs a Management Board and an Inspection Committee that will supervise the Management Board and the General Director. The latter isnot always required if: the company has less than 11 shareholders where no shareholder holds more than 50% of the shares at least 20 % of the Management Board Members are independent members who form an independent auditing committee

Note that by default, you are not required to list shares on a public stock exchange. The requirement applies when your capital exceeds USD 475,000. Alternatives to setting up a legal entity in Vietnam

3. Branch

A branch serves as an extension to its parent company. The parent company must have already been registered for at least five years to establish a branch office in Vietnam.

Branches can engage in commercial activities and earn revenue in Vietnam. Â However, the actions must align with those of the parent company and the parent company bears full liability for the branchâs activities, including its debts and obligations.

With a branch in Vietnam you can: rent offices, and lease or purchase equipment and facilities needed for its operation recruit Vietnamese and foreign employees enter into contracts in Vietnam following the parent company as activity open Vietnamese and foreign currency accounts in Vietnamese banks remit profits purchase and sell goods or conduct other commercial operations consistent with the branch license. Other requirements include oneVietnamese resident as a legal representative.

4.Representative office

Representative officesare similar to branch offices; however, the main difference is that a representative office cannot earn any revenue in Vietnam.

A representative office gives you a legal presence in Vietnam without setting up a company and is ideal for:

conducting market research finding investment opportunities outreaching business partners in Vietnam promoting the parent company supervising agreement signings with Vietnamese partners

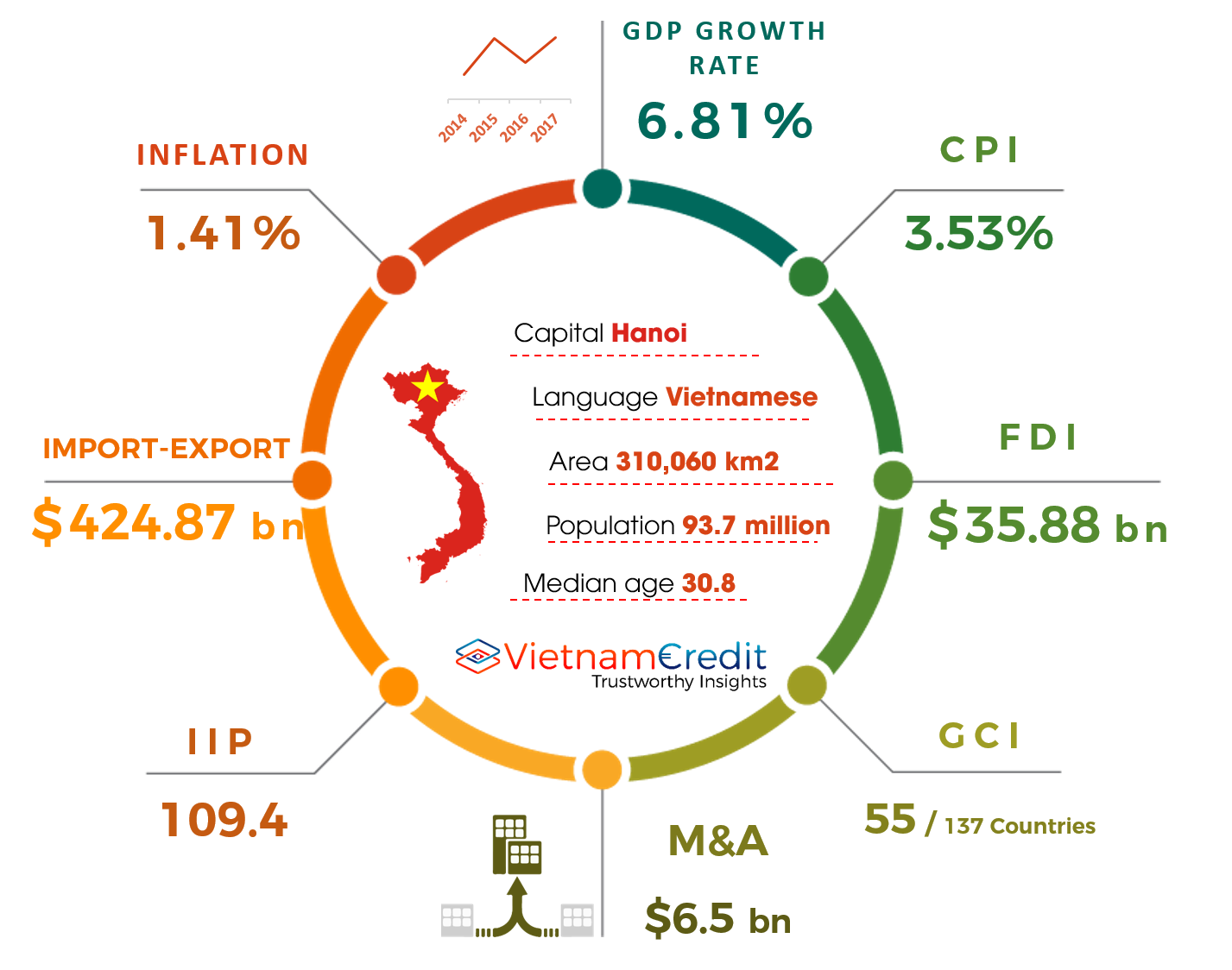

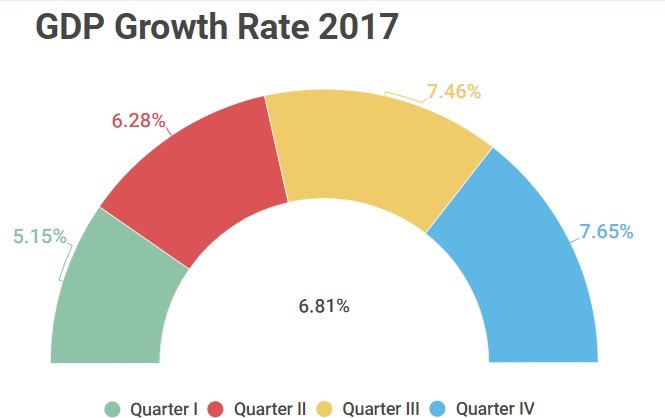

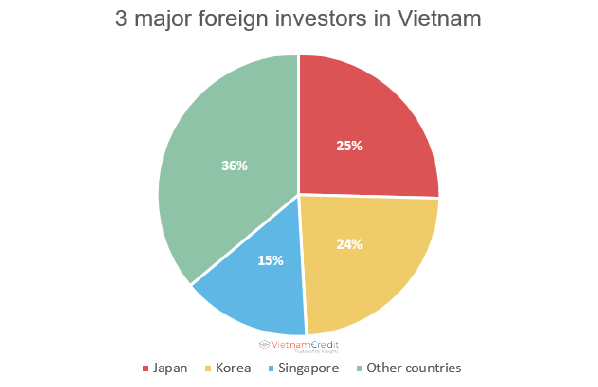

In 2017, Vietnam received USD35.88 billion in FDI, 42.3 percent higher than that in 2016. Implemented FDI is estimated at USD17.5 billion, up 10.8% over the same period last year. Namely, 2,591 new projects have been granted investment certificates.